News

Top 25 Forwarders: DHL stays at the top despite volume decline

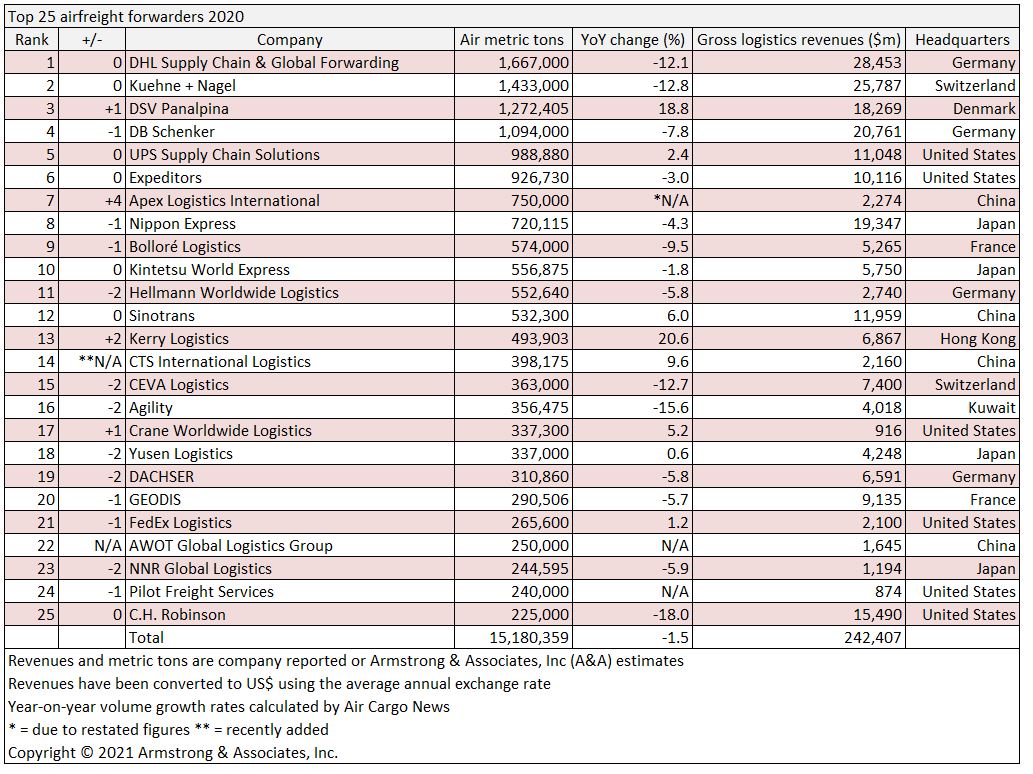

DHL Global Forwarding maintained its position as the leading airfreight forwarder last year despite volumes dropping, while Kuehne+Nagel (K+N) looks set to nab the top spot in the coming years and DSV Panalpina continues its rapid rise up the table (see full table below).

The latest annual market figures from consultant Armstrong & Associates highlight the level of volatility registered in the air cargo market last year, with dramatic variances in performance.

The overall decline in volumes for the top 25 players reflects the Covid-19 outbreak that saw much of the world’s airlines ground their fleets as passenger travel ground to a halt and lockdowns constrained consumer spending.

For market leader DHL Global Forwarding, like many of its peers, 2020 was a tough year in terms of air volumes as a result of the pandemic, although it was a different story for revenues and profits.

The Bonn-headquartered company saw its airfreight volumes decline by 12.1% year on year to 1.7m tonnes.

Looking at the financial performance of its airfreight business, revenues for last year increased by 28.6% on 2019 levels to €6.1bn and gross profit improved by 17.2% to €1.1bn.

Article continues after table

Meanwhile, the world’s number two airfreight forwarder, K+N, reported a similar performance for its airfreight business.

Kuehne+Nagel’s airfreight business saw revenues for the year increase by 11.6% year on year to SFr5.2bn and earnings before interest and tax (ebit) was up by 53.5% to Sfr505m.

K+N’s airfreight volumes for the year declined by 12.8% to 1.4m tons.

In the coming years the forwarder should reach the top spot after in May it completed the purchase of a majority shareholding in China’s Apex Logistics – its largest-ever acquisition – which will add around 750,000 tonnes of airfreight volumes.

Joining the top three for the first time is DSV Panalpina, leapfrogging DB Schenker.

The fast-growing forwarder bucked the overall market trend as it registered a whopping 18.8% year-on-year increase in air cargo demand for the year as volumes touched 1.3m tonnes thanks to its acquisition of Panalpina in the second half of 2019.

The airfreight division saw 2020 revenues increase by 64.9% year on year to Dkk44.8bn and gross profits increased by 55.8% to Dkk10.3bn.

DSV Panalpina is also set to grow. It has announced the purchase of Agility Global Integrated Logistics (GIL) in a deal worth around $4.1bn.

Overall, 2020 was a mixed year for the airfreight market. In general, European forwarders tended to fair worst in terms volume declines with only one of the eight forwarders based on the continent managing to record an increase in demand as lockdowns and slower to recover economies took their toll.

In Asia, Japanese forwarders tended to see volumes decline – although not as strongly as European rivals – while China-based businesses fared better still.

US forwarders tended to perform slightly better than European and Japanese rivals in terms of airfreight volumes thanks to a resurgent economy in the second half.

As a result, three out of the five US forwarders we are able to provide year-on-year comparisons for managed to record an increase.